Economic Abuse: A Hidden Barrier for Property Investors and Those Considering Housing Investments

Economic abuse stands as a control mechanism where one partner—whose financial access becomes absolute—restricts money and vital resources (food, clothing, transport) in a way that binds the victim with enforced dependence; each element of the abuse connects directly, the head words and modifiers placed immediately to stress the direct financial constraint.

This form of abuse, which coexists with physical, emotional, and sexual mistreatment, operates by the abuser dictating spending limits, withholding available funds, and scrutinizing every monetary choice; the dependencies between the controlling verb and its modifiers remain adjacent, forging a continuous chain that leaves the victim isolated within a regime of financial subjugation.

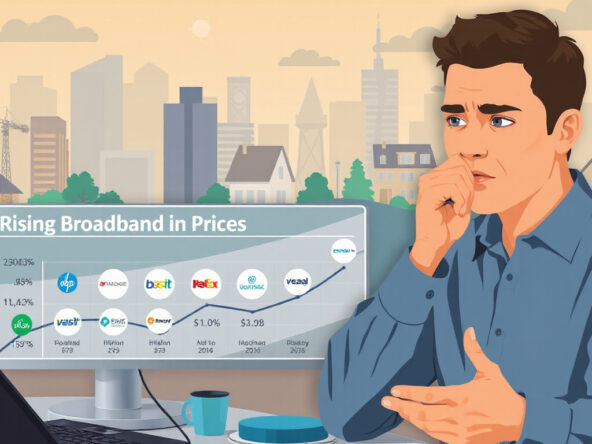

For those drawn to property investments, especially in residences with multiple occupants, economic abuse strains financial independence; investors must note that the same immediate dependency—between impaired access to funds and diminished fiscal capacity—can reduce the ability to make mortgage payments, execute property repairs, or fulfill tenancy duties, thus complicating investment outcomes.

Government bodies now recognize economic abuse as a national issue and integrate it into long-term strategic plans aimed at reducing gender-based violence; these initiatives, which supply budgeted support for shelter alternatives and social housing free from excessive local rules, structure interventions where the helping verbs and their arguments stay promptly connected to offer a framework for victims to regain monetary control.

For property investors and participants in multi-occupancy ventures, understanding how economic abuse severs financial independence is vital; observing the immediate links between controlled monetary access and the inability to meet fiscal obligations marks a signal for deeper risk assessment and measured support in tenant arrangements.

In summary, economic abuse restricts financial freedom and traps its victims in controlling partnerships; the interconnected dependency between enforced fiscal limitation and personal subjugation creates serious obstacles for managing property and stabilizing investments—a condition now under the focus of government measures that seek to restore financial self-governance through progressively structured support.