Edinburgh is currently grappling with a significant homelessness crisis, which has been exacerbated by rising living costs and a shortage of affordable housing. In response, the City of Edinburgh Council has implemented emergency housing measures, utilizing local hotels and bed-and-breakfast establishments to provide temporary accommodation for those in need. Recently, the council announced plans for a...

News

In November 2024, the UK property insurance landscape has been significantly impacted by extreme weather, resulting in an unprecedented surge in claims. The Association of British Insurers (ABI) reported that, from January to September 2024, claims payouts have reached a historic £4.1 billion, a 15% increase since last year. Notably, severe weather events such as storms and floodings have escalated the...

In a move that is set to invigorate the Buy to Let market, Foundation Home Loans has announced the launch of its revamped Specials range, effective from 12th November2024. This new offering provides competitive mortgage rates across two distinct tiers, F1 and F2, aimed at catering to a diverse clientele ranging from first-time landlords to portfolio investors. The innovative approach takes into account...

In a significant move aimed at stimulating economic recovery, the Bank of England has cut its base interest rate from 5% to4.75%. This decision comes in response to a marked decrease in UK inflation, which has reached a three-and-a-half-year low of 1.7% (UK Office for National Statistics, 2023). For borrowers, especially those with variable-rate mortgages, this cut provides a welcomed respite amidst the...

As we approach 2025, the commercial real estate sector is poised for significant transformations driven by evolving market dynamics and innovative strategies. Recent insights from Deloitte highlight how organizations can navigate the complexities of the current landscape while positioning themselves for future growth. Guided by the expertise of seasoned professionals such as Jeff and Kathy from Deloitte,...

In a significant development for the housing landscape in Stretford, Aamer Shah has submitted an ambitious planning application to Trafford Council, aiming to convert an existing two-bedroom semi-detached house on Barton Road into a 10-bedroom house of multiple occupation (HMO). This proposal seeks to respond to the growing demand for affordable housing options while addressing concerns from local...

As the UK grapples with a pronounced housing crisis, the concept of co-living is emerging as a transformative solution to the challenges of affordability and community in urban spaces. Recent insights suggest that the rise in living costs and escalating house prices are fuelling a renewed interest in alternative housing models, particularly in populous cities like London. The Greater London Authority (GLA)...

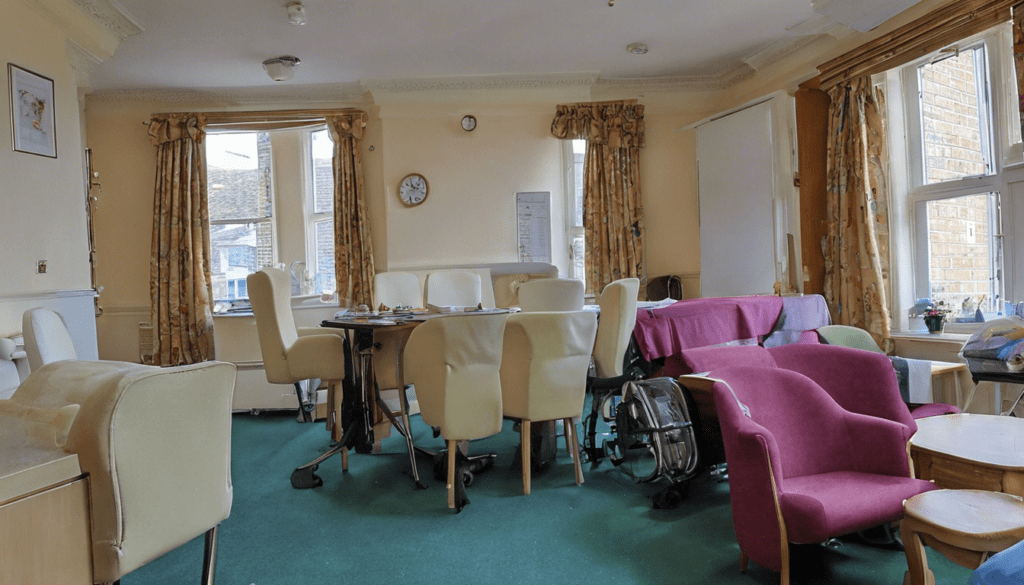

Councillors in Broadstairs are preparing to discuss a contentious proposal that aims to convert the Kent House nursing home into a House of Multiple Occupation (HMO). The application, submitted by Mr. Inderjeet Singh Toot of N & I Holdings Limited, seeks to transform the facility into a 21-bed HMO with minimal structural changes, despite existing concerns from the community regarding loss of care services,...

In an intriguing development for London's luxury real estate market, the Poonawalla family has made headlines with their recent acquisition of a £42 million property located in the prestigious Grosvenor Square. This investment marks a pivotal moment not only for the Poonawalla family—one of India's wealthiest and most influential families—but also for the broader implications of upcoming tax reforms...

In a significant boost for landlords across Yorkshire, Foundation Home Loans has rolled out a series of competitive Buy-to-Let Specials, effective from November 12,2024. These newly updated specials are differentiated into two distinct tiers: F1, tailored for borrowers with nearly clean credit histories, and F2, which caters to clients owning specialist properties or those facing specific credit...