UK Housing Market Shows Strong Activity but Modest Price Growth in Summer 2025 The UK housing market, summer 2025, stands active; buyers demand, sales surge, property listings record high—market pulse beating briskly even as house-price climb remains muted. Current Market Overview June 2025 reveals an average house price near £268,400; this value, growing 1.3% per annum, contrasts with a prior rate of...

Property Reporter

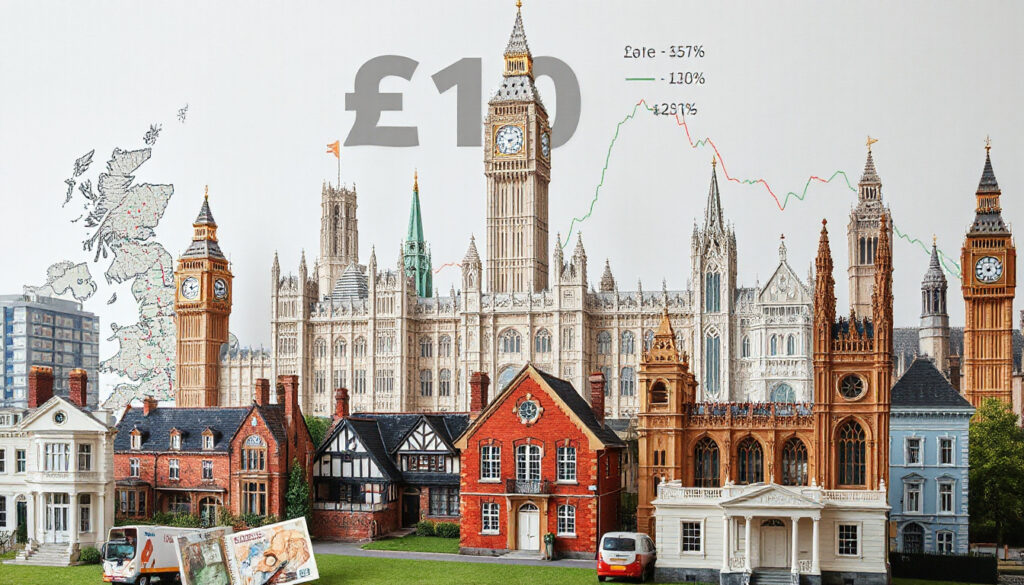

Foreign Investment Fuels UK's Commercial Real Estate Recovery The UK commercial real estate sector manifests a surge: foreign direct investment enters, investors cluster, capital concentrates. International investors now hold 40% of a £600 billion institutional property stock. Data records an increase from 15% in 2003. Domestic market shifts push capital outward. Changing Investment Patterns Real estate...

House Price Trends: Insights for Potential Property Investors House prices link closely with market data. Investors note that prices change as the market shifts. Data tie economic force to price movement; regions show distinct price behavior. Current Market Overview House prices vary as nodes connected by economy, rates, supply, and demand. Some regions show price increases; others show steady or falling...

Understanding Current House Prices: A Focus for Property Investors Investors—property and market—confront oscillating price variables; market shifts, economic indicators, and demand metrics connect, drive, and inform decision-making. Comprehension of these connected fluctuations enables informed yet complex judgment. Recent Trends in House Prices The market exhibits trends where economic pressure,...

Current Trends in the Housing Market: A Focus on House Prices UK housing market evolves; economic forces, regulatory measures, and financial indices bind together, rising and falling in immediate proximity. Investors—eyes fixed on HMO developments—observe house prices, factors, and market signals converging rapidly. Key Market Insights Reports document market fluxes; factors such as interest...

Current Trends in House Prices The property market evolves; house prices change in ways that depend on many nodes. Homeowners and potential agents alike witness the market’s advance, where price movements attach directly to factors—economic conditions, interest rate shifts, housing demand—that link tightly with pricing outcomes. Overview of House Price Trends Recent observations record house price...

UK Commercial Real Estate Market Sees Decline, Overseas Ownership Rises In 2023 the UK real estate market, its total value encompassing residential and commercial assets, registers near £9.3 trillion, its component commercial property—whose decline emerges from yields rising in lockstep with bond returns and interest escalations—contracting from a peak of over £1.1 trillion in 2020 to roughly £949...

Overseas Investors Gain Ground as UK Commercial Property Market Declines in Value UK property analysis reveals trends—ownership shifts, valuation falls. By 2023 the total, residential plus commercial, nears £9.3 trillion. Commercial value, once near £1.1 trillion, now drops to under £950 billion. The numbers show change. Yields rise; bond rates climb; values contract. Commercial Property Values and...

London’s Luxury Property Market Faces Further Decline Amid Changing Tax Landscape London’s property market, where luxury assets once asserted dominance, now endures a pronounced decline—a decline marked by pricing contractions exceeding twenty percent from previous zeniths and signaled by the waning interest of wealthy buyers whose capital once buoyed high-end investments. The removal of a...

Understanding Current Trends in Property Investment: Focus on House Prices The property market evolves as investors in HMOs confront a data network where house prices, a primary fiscal indicator, forge a link with both short-term tactical moves and long-term strategic allocations in residential real estate that demand comprehension and measured response. Current House Price Trends Recent analytical studies...