Understanding Current House Prices and HMO Investment Potential

The market shifts. The property field evolves. Investors, whether current or eyeing entry, must grasp trends. HMOs come to matter. They yield rents that, in many cases, top those from single-family houses.

Market Trends

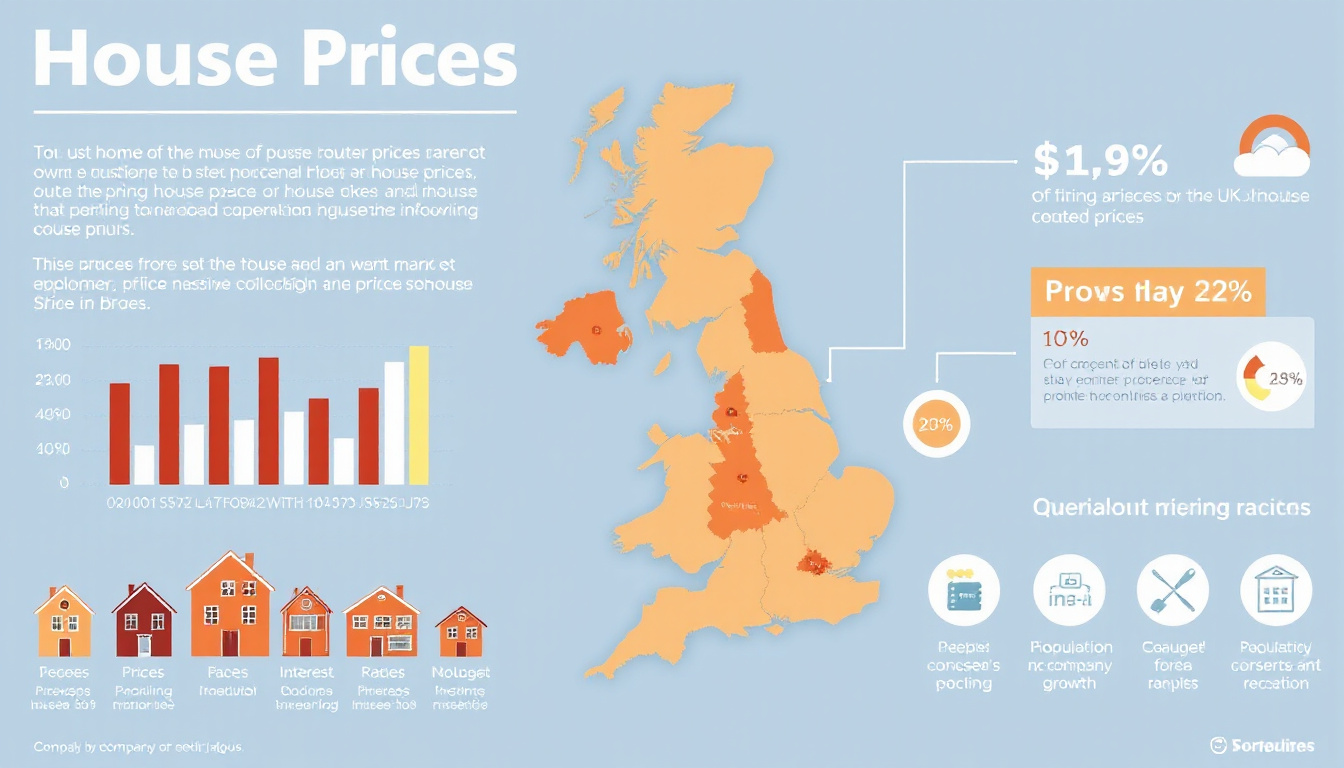

House prices oscillate. Economic states push them. Interest rates drive them. Regional needs move them. Investors note that each factor joins the next in cause and effect. In urban cores, rental space draws many; HMOs then become a matter of choice. Local rental climates, available amenities, and tenant pulls knit together a scene that demands sharp analytical judgment.

Rental Demand Insights

Rental need stays high. Young experts and students join in. These groups pick shared rooms. HMOs thus appear as conversion nodes in the property net. Investor work must study the market data. Safety rules and space laws connect to profit margins. Market shifts, rule revisions, and compliance issues sit in close relation.

Investment Strategies

A spread-out focus guards risk. Investors mix property types. HMO picks, alongside buy-to-let steps, shape a multifaceted plan. Data on local demand thus binds to transport nodes and location merits. Each decision forms a link in a chain of risks and returns, which investors must trace with attention.

Conclusion

Property investments, with attention to HMOs, show income avenues. Trends in house costs, data on rental need, and varied strategy choices join in a network that places each investor in a dynamic arena of risks and gains. Staying alert to change and binding market elements ensures one may position oneself within the shifting property field.